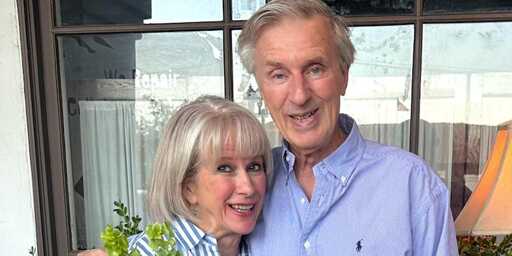

Joel and Kathryn Friedman, both 71, are counting the days until they can sell their home and move into a 55-plus community.

The retired empty-nesters have been ready to downsize for years, but are reluctant to sell their five-bedroom, 5,000-square-foot Southern California house [mansion] in large part because of at least $700,000 in capital gains taxes they estimate they’d have to pay.

Since 1997, home sale profits over $500,000 (for married couples) and $250,000 (for single filers) have been subject to a capital gains tax of up to 20%. That threshold hasn’t changed since 1997, meaning that — between inflation and soaring home prices pushing an ever higher number of houses above that limit — many more home sellers have to pay the tax now than when it was first implemented.

The Friedmans are among a growing number of older homeowners discouraged by the tax from selling their valuable properties. Housing economists say that dynamic has exacerbated a shortage of family-sized homes on the market, especially in expensive places like California.

The Friedmans’ house is too big for them, and maintenance costs are only rising, Joel said. “There are a million reasons why we’d like to move, but we’re not because the tax is just burdensome,” he said.

But that could change — there’s bipartisan support in Congress for raising the federal tax threshold to boost home sales in a stagnant market.

To explain in a nicer way where your error in thinking is:

You don’t pay the taxes specified in the article on the whole amount of money you get for selling your house, only on the increased value compared to when you bought it.

So as example: you buy the house for 1 million and sell it later for 2 million. Then the tax in the article is only applied to the 1 million difference, so you only give away part of the money that you got in addition to the value you bought the house for. So you always end up with more money than you paid for the house, just not the full value.

Right but the rest of the housing market has also moved on. The cost basis of that house won’t come anywhere near buying equivalent housing in the present

Let’s say you bought a decent house back in the day for 100k, and now that house can go for 500k because it’s a typical family home and all those homes are now 500k.

Let’s say your spouse dies and you could stand for a different house, maybe closer to a family member that can help take care of things. You can sell your house for 500k, but you are left with only 420k that you keep. Sure you could easily afford 100k homes if they still existed, but now homes cost as much as you sold yours for.

The real kicker is there is a like-kind exemption that would negate this, but it’s not allowed for your actual primary residence, only as an investment property. Landlords are protected from this but residential homeowners are not.

I don’t have an error. If you buy a house for $200k (average price for houses in the US some years ago) and it now costs $500k (average price for houses in US today), this tax makes it LITERALLY impossible for you to sell your house and buy another one. This is a new phenomenon.

That part is normal?

For real estate there is always a loss involved. Because multiple people and their work are involved and the state also wants their taxes of course. What you want seems to be ‘government not involved’ market of real estate and I’m not really a fan of unregulated markets. They tend to fuck us normal persons even more.

The discussion for this article is about downsizing the house and that is definitely possible, even after paying that tax.

You think it’s normal to lock the US population into place, decrease housing market liquidity, reduce inventory, and drive up home prices?

Here’s what I think is normal: the primary residence, which is traditionally the primary stock of wealth for the working and middle classes, should not be taxed. Period. Your second house should be taxed. Your third house should be taxed. Your huge boat should be taxed. Not your home.

People need to stop their war on the US middle class, which is rapidly disappearing. The majority of the wealth is in the hands of the top 1-10%. Not the middle 50, or the working poor, who are the most impacted by this moronic tax.

Behold, the impact of property taxes: