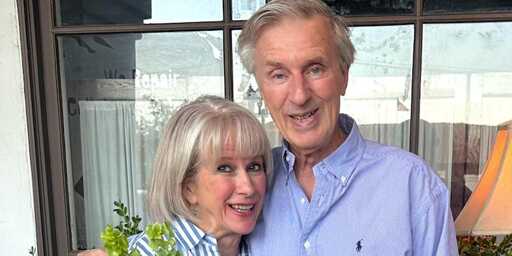

Joel and Kathryn Friedman, both 71, are counting the days until they can sell their home and move into a 55-plus community.

The retired empty-nesters have been ready to downsize for years, but are reluctant to sell their five-bedroom, 5,000-square-foot Southern California house [mansion] in large part because of at least $700,000 in capital gains taxes they estimate they’d have to pay.

Since 1997, home sale profits over $500,000 (for married couples) and $250,000 (for single filers) have been subject to a capital gains tax of up to 20%. That threshold hasn’t changed since 1997, meaning that — between inflation and soaring home prices pushing an ever higher number of houses above that limit — many more home sellers have to pay the tax now than when it was first implemented.

The Friedmans are among a growing number of older homeowners discouraged by the tax from selling their valuable properties. Housing economists say that dynamic has exacerbated a shortage of family-sized homes on the market, especially in expensive places like California.

The Friedmans’ house is too big for them, and maintenance costs are only rising, Joel said. “There are a million reasons why we’d like to move, but we’re not because the tax is just burdensome,” he said.

But that could change — there’s bipartisan support in Congress for raising the federal tax threshold to boost home sales in a stagnant market.

700k is 20% of 3.5 million

That leaves 2.8 million

If put into savings with a 4% annual interest rate, that is 112k per year

And they are complaining?

You fucking kidding me?

The first $500k is taxed at a lower rate, so they’re actually making more than that on the sale.

Agreed… this couple isn’t hurting either way.

However as they said the limit hasn’t changed in almost 20 years. For most older people in America their home is the single most valuable possession and what many have to sell when they are unable to care for themselves and have to go into some kind of care facility. For people living in a HCOL area, their home can easily be many times more valuable than their savings and their primary or only asset of significant value, and a $1M house is a starter home.

It makes sense for the limits to be increased, but the couple that’s the subject of this article doesn’t deserve anyone getting teary-eyed.

2.8 million dollars is more than most people have the ability to save for retirement in the first place.

They want us to cry for them because their payout from a single asset after tax is more than the average middle class retirement account?

Get fucking real, if anything this makes me think the capital gains tax is too low for their bracket.

Also at their age they could live on that money until they die. I hope an earthquake takes out the home making it worthless. Fucking greedy bastards. They are Fucking 71.

at my age i can live on that money until i die and i’m much younger.